Top Investment Projects in Mohali–Kharar: Why The Rise Brand Avenue & Mohali High Street Are the Next Big Commercial Boom (2025–2030)

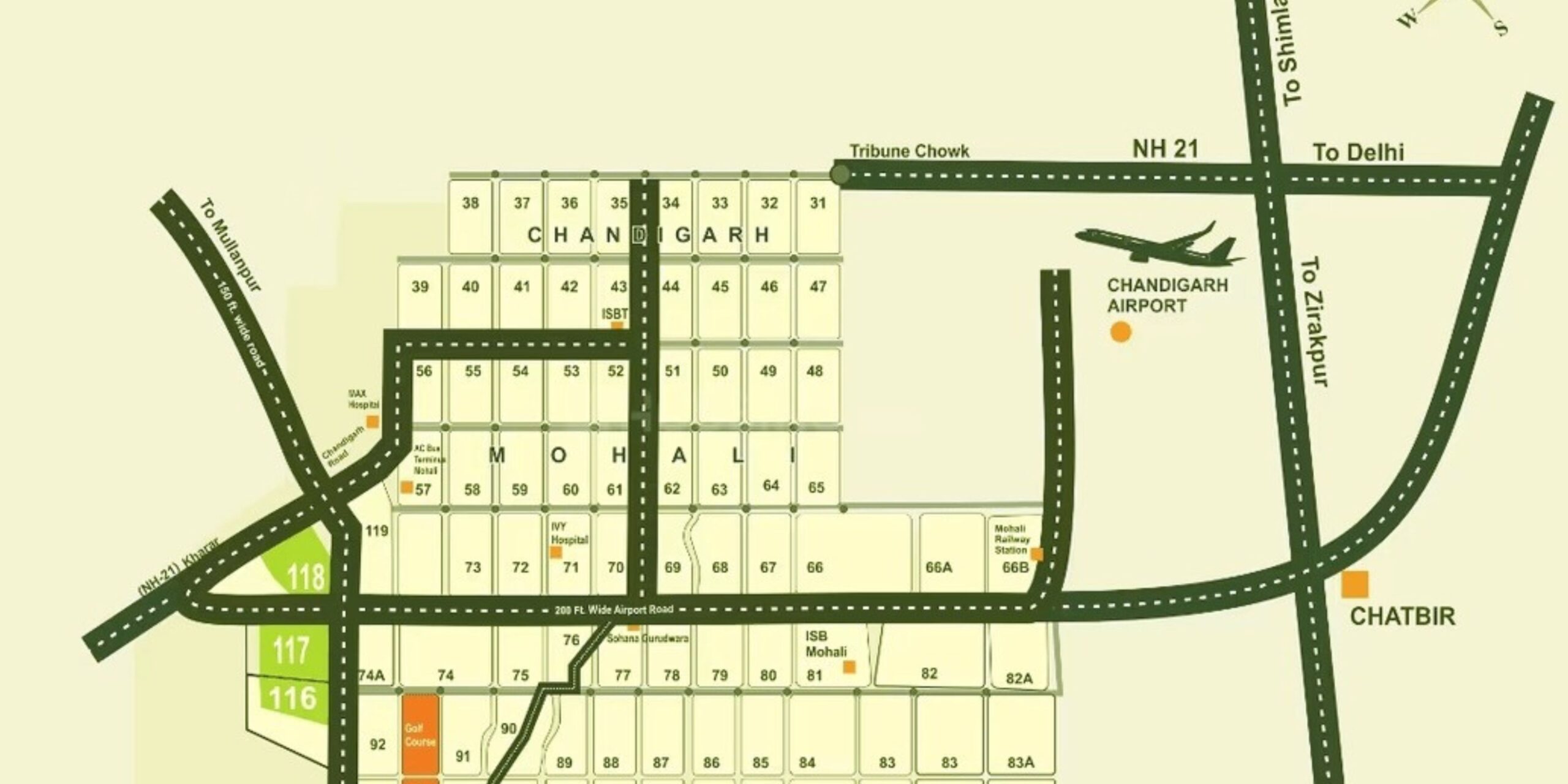

Mohali–Kharar is rapidly becoming the new commercial heart of North India. With Chandigarh reaching its saturation point and Zirakpur turning premium-cost, the Tricity region’s next major retail, dining, and entertainment boom is shifting towards Mohali, Kharar, Kurali, and the rapidly developing highway belt.

Driving this boom are three factors:

1. Rising residential population,

2. Highways becoming commercial corridors,

3. Lifestyle spending increasing across Punjab.

Within this market shift, three standout commercial projects are emerging as the most powerful investment opportunities:

1. The Rise – Brand Avenue (Kharar–Ludhiana Highway)

2. Antaara – The Joyful Side of Life (Rapar–Chandigarh Highway)

3. Mohali High Street (Coming Soon)

Each project captures a different consumer segment — from high-footfall retail to premium lifestyle and luxury commercial — forming a complete investment ecosystem.

Why Mohali–Kharar Will Lead the Commercial Growth Wave

Massive Population Boom

Thousands of new housing units, universities like Chandigarh University, and continuous migration from Himachal, Haryana, and UP are driving population numbers higher every year. This directly increases demand for:

Food outlets

Retail shops

Clinics and wellness centers

Supermarkets

Entertainment hubs

Highway-Led Commercial Evolution

The belts around:

Chandigarh–Ludhiana Highway

Chandigarh–Manali Highway

Mohali–Kurali 6-lane corridor

Bharatmala Expressway

have become the busiest commercial corridors of North India. Businesses prefer these locations due to constant moving traffic, wide visibility, and easy access.

Shift From Chandigarh to Mohali–Kharar

Brands want larger spaces, better parking, and lower rentals, which Mohali–Kharar offers in abundance. This brand migration strengthens rental demand and investor confidence.

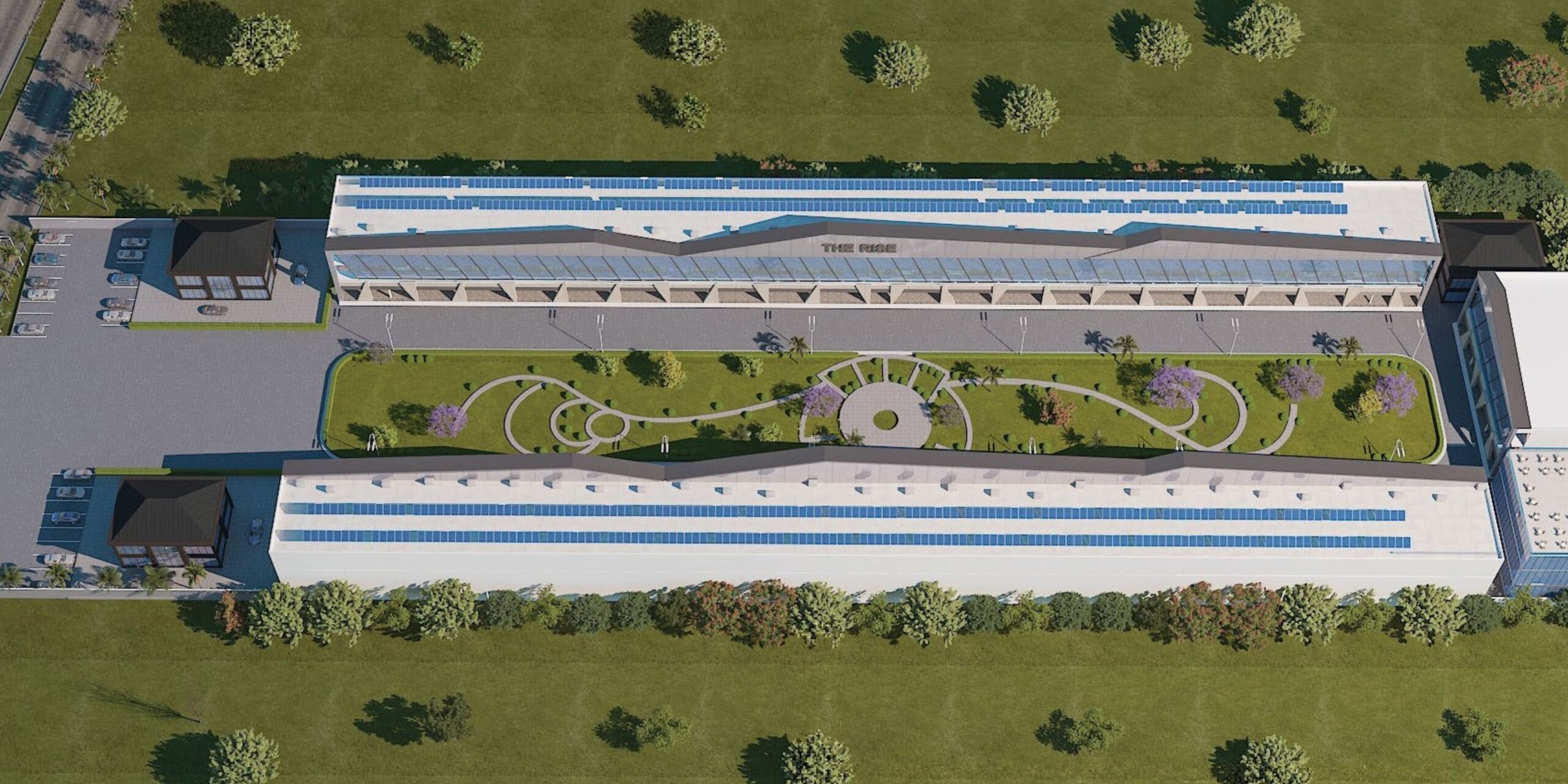

Project 1: The Rise – Brand Avenue (Highway-Front Commercial Hub)

Antaara-1

The Rise is a modern commercial high-street development built on the Chandigarh–Ludhiana Highway (NH-205), a high-traffic road connecting local residents, students, and intercity travelers.

Prime Location Advantage

The project sits close to:

Mohali Bus Stand

Airport Road

Max Hospital

Chandigarh city

Residential belts of Kharar & Gharuan

Its wide highway-facing entry ensures maximum visibility, making it ideal for retail and F&B brands.

Modern Commercial Infrastructure

The Rise includes:

24×7 CCTV

Boom barrier entry

Wi-Fi enabled zones

Purified water supply

Power backup

Wide walkways

Ample parking

These features attract tenants like banks, branded showrooms, fast food chains, medical clinics, co-working, salons, and supermarkets.

Smart Product Mix

The project offers:

High-street retail shops

Showrooms

Two exclusive drive-through units

Service-friendly commercial design

Drive-through units are especially valuable, as they appeal to national F&B brands and deliver higher rentals.

Investment Performance

The Rise showcases strong projections in:

Rental yields increasing steadily

Capital value growth year after year

Rising footfall from surrounding residential townships and the highway

The combination of residential density + student population + highway traffic makes this one of the most stable retail investment zones in Kharar.

Project 2: Antaara – The Joyful Side of Life (Luxury High Street on Bharatmala Expressway)

Antaara is a luxury lifestyle commercial destination spread over 6.5 acres, with an impressive 400-ft wide highway frontage — a rare offering in the Tricity region.

It is positioned as a Shopping | Dining | Entertainment hub designed for premium experiences.

Strategic Location on a National Corridor

Antaara stands at the junction of:

Bharatmala Expressway

Chandigarh–Manali Highway

Mohali–Kurali 6-lane corridor

This location brings together:

Local residential traffic

Highway commuters

Tourists returning from Manali

Shoppers from Chandigarh, Ropar & Mohali

This triple-layer footfall makes Antaara a future mega-destination.

Premium Commercial Mix Designed for High Spending Audience

Antaara includes:

Pre-leased showrooms (multi-level)

Double-storey high-street shops

Anchor stores

Multiple drive-thrus

Commercial plots for large brands

Global fashion & luxury retail

Supermarkets & hypermarkets

Spa, salon & wellness centers

Fine-dining restaurants & cafes

Entertainment & fun zones

Electronics & digital stores

Boutique fashion outlets

A 10,000 sq. ft. mega food court

Space suitable for boutique hotel or nightclub

This range ensures footfall from morning until late night, making Antaara a full-day commercial destination.

Why Antaara Stands Out for Investors

Antaara is engineered for:

Strong visibility

High-end tenants

Low maintenance cost

Long-term rental stability

Assured occupancy

Luxury shopping experience

Its positioning targets an audience with higher disposable income, making rentals and resale values significantly stronger.

Developer Credibility

Antaara is backed by the Maya Garden Group, a trusted name with:

25+ successful projects

Over 100 lakh sq. ft delivered

This gives investors massive confidence in delivery, construction quality, and project lifecycle appreciation.

Project 3: Mohali High Street (Premium Urban High-Street Retail)

Mohali High Street represents the pure urban commercial segment, located within the Mohali city belt. It targets:

Boutique brands

Cafes & F&B outlets

Lifestyle and fashion retail

Premium service businesses

Electronics & gadgets

Branded salons & studio outlets

Its strength lies in the affluent Mohali population, proximity to Airport Road, and the continuous influx of higher-income families moving from Chandigarh.

High-street retail inside Mohali has:

Lower vacancy rates

Higher rental growth

Strong resale market

Consistent weekend walk-ins

This makes Mohali High Street perfect for investors seeking steady, premium footfall instead of highway-driven transient traffic.

Investment Comparison: Which Project Fits Which Investor?

| Feature | The Rise | Antaara | Mohali High Street |

|---|---|---|---|

| Primary Audience | Mass retail | Luxury & lifestyle | Premium urban |

| Location Type | NH-205 highway | Bharatmala Expressway | Inside Mohali |

| Footfall Strength | Students + locals | Luxury + tourists + locals | Mohali premium crowd |

| Rental Income | Fast & stable | High & premium | Strong urban rentals |

| Capital Appreciation | 14–20% | 16–24% | 15–22% |

| Best For | Investors seeking quick returns | Long-term wealth builders | Boutique & F&B investors |

Why These Three Projects Will Outperform the Market

1. Strong Residential Growth Around Them

The entire Mohali–Kharar–Kurali belt is witnessing rapid migration and housing demand.

2. Different Segments, No Internal Competition

The Rise → High-footfall mass retail

Antaara → Luxury lifestyle destination

Mohali High Street → Premium urban high-street

They complement each other rather than compete.

3. Brand Attraction

Modern façade, wide frontage, and structured layout naturally pull in:

Café chains

Restaurants

Gyms

Salons

Fashion brands

Electronic outlets

Medical and wellness brands

4. Strong Long-Term Appreciation

Due to rising traffic, brand occupancy, and land scarcity, each project is positioned for strong long-term capital growth.

5. Shift Toward Organized Retail

Consumers prefer:

Parking

Safety

Clean layout

Airy walkways

Well-managed commercial spaces

These projects deliver exactly that.

2035 Commercial Forecast: What Investors Can Expect

2025–2027

Retail occupancy stabilizes

Brands actively take space

Rentals rise steadily

2027–2030

Rapid price escalation

High resale demand

Local population doubles in nearby areas

2030–2035

Commercial land becomes scarce

Appreciation peaks

Early investors can see 3–4× capital growth

Rental yields potentially touch 12–14%

Final Recommendation: Which Project Should You Choose?

1. Want quick returns + mass footfall + affordable entry?

👉 The Rise – Brand Avenue

2. Want luxury tenants + premium rentals + huge frontage + tourist footfall?

👉 Antaara – The Joyful Side of Life

3. Want urban crowd + boutique brands + long-term premium hold?

👉 Mohali High Street